Portugal among the world’s best places to retire in 2022

According to the 2022 Annual Global Retirement Index from International Living, Portugal is among the World’s Best Places to Retire, coming fourth on the top 10 ranking.

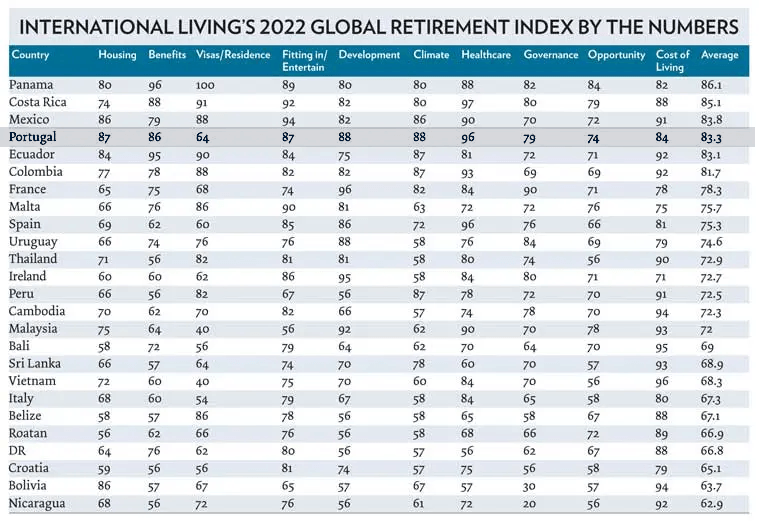

This Index is a “selection of outstanding destinations where you can live a healthier and happier life, spend a lot less money, and get a whole lot more” and it is informed by writers who actually share their own experience in each country, “where they’re gathering their intelligence” and coming up with handful information about each destination. The ranking’s criteria range from Housing, Benefits, Residency, Fitting in/Entertainment, Development, Climate, Healthcare, Governance, Opportunity, and Cost of Living.

As mentioned, Portugal ranks 4th on the Index, following three Central America countries: Panama (1st), Costa Rica (2nd) and Mexico (3rd). The indicators where Portugal scored the most are Healthcare, Climate and Development.

When it comes to describing the country, it is mentioned that even though there are “vibrant cities full of Old-World charm, miles of golden sandy beaches, green, rolling hills, some of the best healthcare in the world, low cost of living, and safety”, in fact, what is on top of the preferences by the correspondents is the Portuguese people.

The Index by the numbers:

Source: International Living