New Golden Visa Rules are Finally Published

The Portuguese Government has finally published on 12th of February the so waited new rules regarding the residence permit by investment (Decree-Law no. 14/2021 of 12th February), more commonly known as the Portuguese Golden Visa.

These new rules will only enter into force on the 1st of January 2022. This is good news, as investors still have until the end of the year to be under the current law.

The legal changes will be as follows:

- The Financial Investment type, which means the transfer of at least €1 million, will change its minimum to €1.5 million.

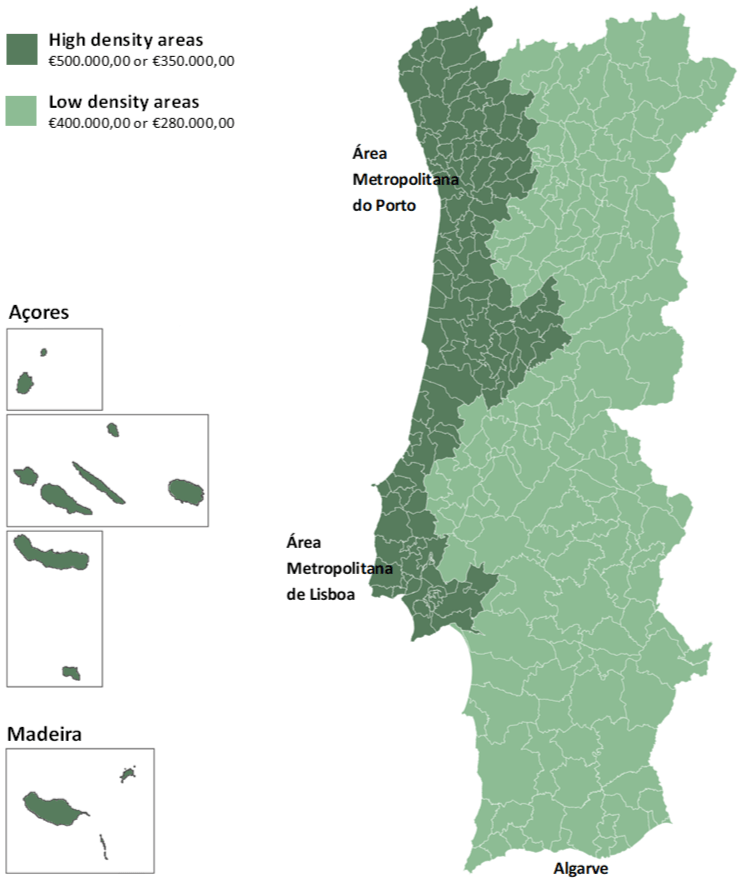

- The Real Estate Investment type and the Real Estate Investment and its rehabilitation for non-residential purposes will both remain unchanged, such investments being of at least €500,000.00 (reduced to €400,000.00 if located in a "low density area"), or €350,000.00 (reduced to €280,000.00 if located in a "low density area").

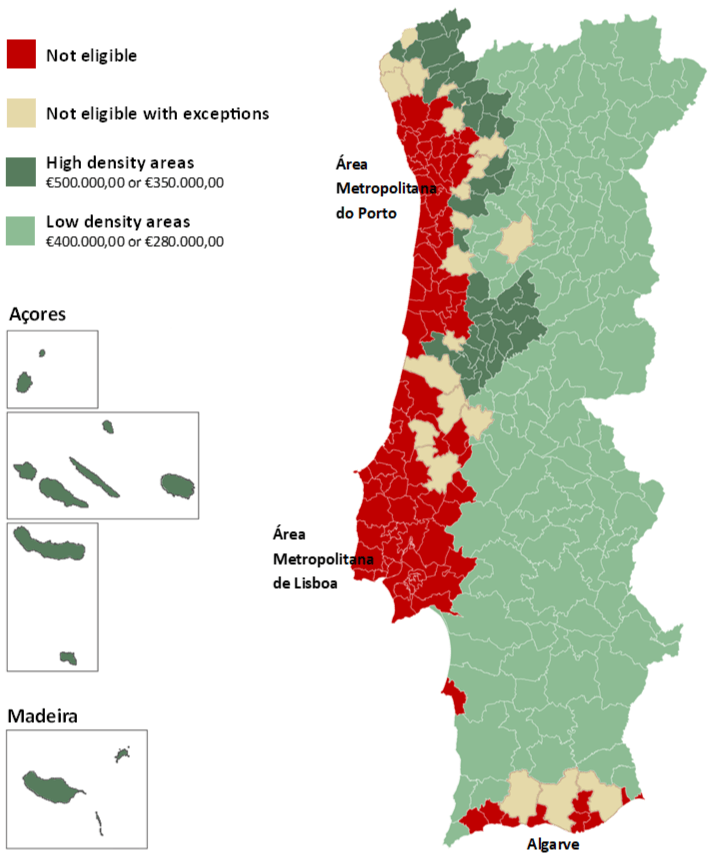

- The Real Estate Investment and the Real Estate Investment and its rehabilitation for residential purposes will be limited to properties located in the interior territories of Portugal, identified in the Annex to Ministerial Order no. 208/20017 of 13th July, and in the islands of Madeira and Azores, and will keep the same investment minimum amount: €500,000.00 (reduced to €400,000.00 if located in a "low density area"), or €350,000.00 (reduced to €280,000.00 if located in a "low density area").

- Therefore, Real Estate Investments for residential purposes will be excluded from the Golden Visa scheme in the

Lisbon Metropolitan Area, the

Oeste territory, the

Porto Metropolitan Area (except for the Municipality of Arouca and the parishes of Junqueira and Arões in the Municipality of Vale de Cambra) and in almost all of the

Algarve territory. The exceptions in the Algarve are the Municipalities of Alcoutim, Aljezur, Castro Marim, Monchique and Vila do Bispo, the parishes of Alte, Ameixial, Salir, Union of Parishes of Querença, Tôr and Benafim in the Municipality of Loulé, the Parish of São Marcos da Serra in the Municipality of Silves, and the Parishes of Cachopo and Santa Catarina da Fontes do Bispo in the Municipality of Tavira

- The Investment in scientific research that is conducted by accredited institutions that are part of the national scientific and technological system also changes from €350,000.00 to a minimum amount of €500,000.00 (reduced to €400,000.00 if located in a "low density area").

- The Investment in units of Portugal-regulated funds dedicated to the capitalisation of companies, provided that the fund invests at least 60% in Portugal-registered businesses, and that the maturity of said units is no less than 5 years from the date they are bought, changes from €350,000.00 to a minimum amount of €500,000.00.

- The Investment in setting up a Portuguese company that creates and keeps 5 new permanent jobs, or in increasing the share capital of an existing Portuguese company that creates or keeps at least 5 permanent jobs for a minimum period or 3 years, changes from €350,000.00 to a minimum amount of €500,000.00.

We stress that all the Golden Visa applications submitted until the 31st of December 2021 will benefit and be granted under the current rules, which means that the above mentioned changes will be applicable only to investors and their families who submit their application after the new Decree-Law comes into force.

We remain available should you require any further information from us, and we would be keen in assisting you with your Golden Visa application in Portugal.