Establishing a Company in Portugal: Key Considerations and How to Get Started

Tomás Melo Ribeiro | Lawyer

Portugal is an increasingly popular choice for entrepreneurs and businesses looking to establish a presence in Europe. The country offers several benefits that make setting up a company here practical and advantageous.

1. Advantages of Establishing a Company in Portugal:

- Favourable Corporate Tax Rate: Portugal offers a corporate income tax rate of 20%, which is among the most competitive in the European Union. By comparison, corporate tax rates are 25.8% in the Netherlands, 32.02% in France, 25% in Spain, 24% in Italy, and approximately 30% in Germany. ¹

- Support for Entrepreneurship: The Portuguese government has implemented the

Startups Framework (Law no. 21/2023), which introduces several incentives for emerging businesses, including:

- Income Tax Exemption on Stock Options: Providing a more favorable tax regime for employees of startups.

- Reduced Corporate Income Tax: Offering lower tax rates during the initial years of a startup’s operation.

- IMT Exemption: Applicable to startups acquiring property for business activities.

- Access to the European Single Market: Companies established in Portugal benefit from the freedom to trade and provide services throughout the European Union, enabling streamlined access to a vast consumer base.

2. Methods to open a company in Portugal

There are three primary ways to establish a business in Portugal: online, in person, and through the “Empresa na hora” (instant company setup).

Online Registration:

- This is the most convenient and efficient method for those who prefer a digital approach.

- You can complete the full process of registering a business on the Portuguese Tax Authority’s website (Portal das Finanças) and the Commercial Registry Portal (Registo Comercial).

- This method allows you to submit documents, complete all necessary forms, and receive your company registration remotely. It’s an ideal option for entrepreneurs who prefer a paperless process and can manage everything from home or the office.

- Online registration is suitable for a range of business structures, including Sole Proprietorships, Limited Liability Companies (Lda.), and others.

In-Person Registration:

- This method requires physically visiting the Commercial Registry (Conservatória do Registo Comercial) or a Public Notary in Portugal to submit the necessary documents.

- You will need to fill out forms, provide identification, and register with the relevant authorities.

- This option may be preferable for individuals who want to ensure personal guidance during the process, especially when dealing with more complex structures or legal advice.

- While it may take a bit longer compared to online registration, it offers an in-person, direct approach to starting a business.

Empresa na Hora (Instant Company):

- The Empresa na Hora (Company in One Hour) service is a highly efficient method for opening a business in Portugal within a single day.

- Through this service, you can create a Limited Liability Company (Lda.) or a Sole Proprietorship quickly. The company is established and registered on the spot.

- This option allows entrepreneurs to finalise all legal steps, including obtaining the NIF (Tax Identification Number), registering with the Portuguese Commercial Registry, and obtaining the certificate of incorporation, all within an hour.

- Empresa na Hora is available at designated

Empresa na Hora centres across Portugal, making it ideal for those who want to start their business immediately.

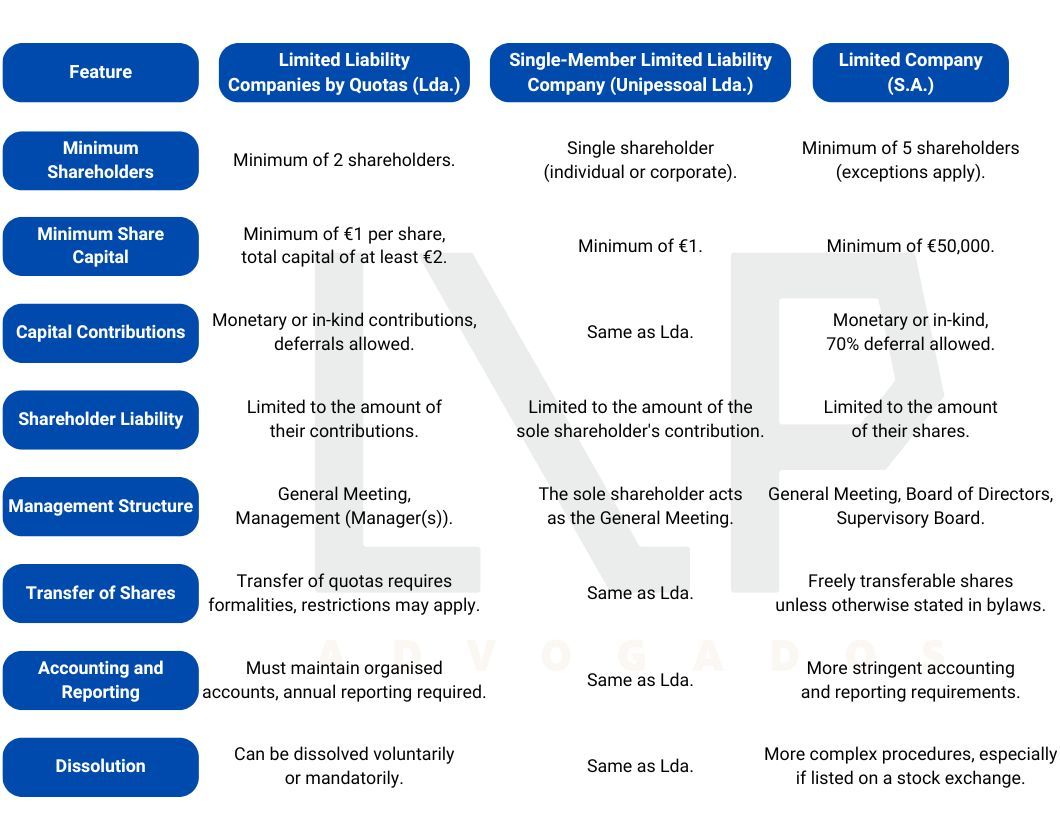

The most common corporate structures in Portugal include:

- Limited Liability Companies by Quotas (Lda.)

- Single-Member Limited Liability Companies (Unipessoal Lda.)

- Public Limited Companies (S.A.)

The following chart addresses the main features of each structure:

4. Procedure for Online Company Formation in Portugal

The incorporation process involves several key steps:

- Selection of the Company Name: Applicants may choose a pre-approved "fantasy name" or request a certificate of admissibility from the National Register of Legal Entities.

- Definition of Share Capital: Contributions may be made in cash or in kind, with flexibility regarding the timing of the contributions.

- Establishment of Corporate Purpose: Clearly define the economic activities the company intends to pursue.

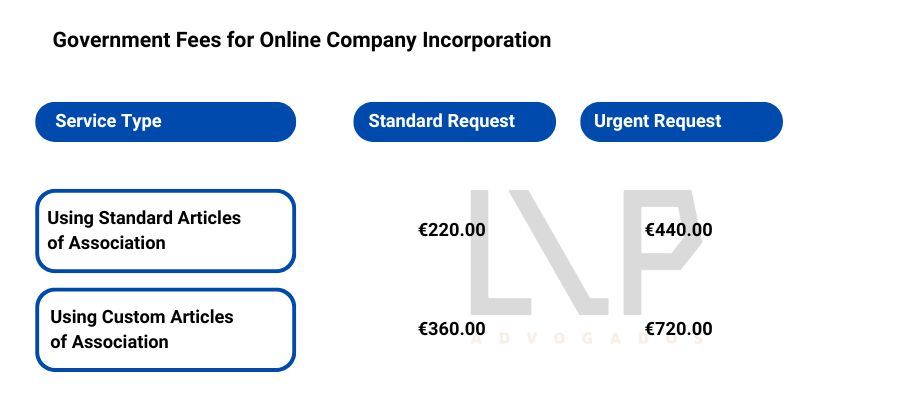

- Preparation of the Articles of Association: Applicants may adopt a standardised model or submit bespoke articles tailored to the company’s specific needs.

Additional Procedural Elements

- Appointment of a Certified Accountant: It is advisable to designate a certified accountant during incorporation to manage the company’s accounting and financial obligations.

5. Post-Incorporation Formalities

Upon successful completion of the incorporation process, the relevant public authorities will:

- Register the Company Electronically, providing immediate confirmation of its legal status.

- Issue the Company’s Electronic Card and Social Security Identification Number (NISS), which are essential for operational purposes.

- Provide Access to the Permanent Commercial Registry Certificate, which is available electronically and valid for three months.

To ensure compliance with all legal and tax obligations in Portugal, the interested parties will need to take, after incorporating a company, the following steps:

- Beneficial Owner Registration Declaration: The interested parties need to submit the Beneficial Owner Registration Declaration to the Portuguese Commercial Registry. This declaration provides information about the individual(s) who ultimately own or control the company. It is a legal requirement to ensure transparency.

- Opening a Bank Account for the Company: This account will be used for the company’s financial transactions, such as depositing the share capital and paying operational expenses.

- Filing the Declaration of Commencement of Activity: This process formalises the company's business activity with the Tax Authority and determines the applicable tax regime (e.g., VAT, corporate tax), and it must be made within 30 days of the company’s incorporation to avoid penalties.

How LVP Advogados Can Assist You

At LVP Advogados, our team of legal professionals offers comprehensive support throughout the company incorporation process. We provide tailored advice to ensure compliance with Portuguese regulations and facilitate a smooth and efficient establishment of your business in Portugal.

Contact us today for further information and to discuss how we can assist you in achieving your corporate objectives in Portugal.

¹https://pt.tradingeconomics.com/country-list/corporate-tax-rate