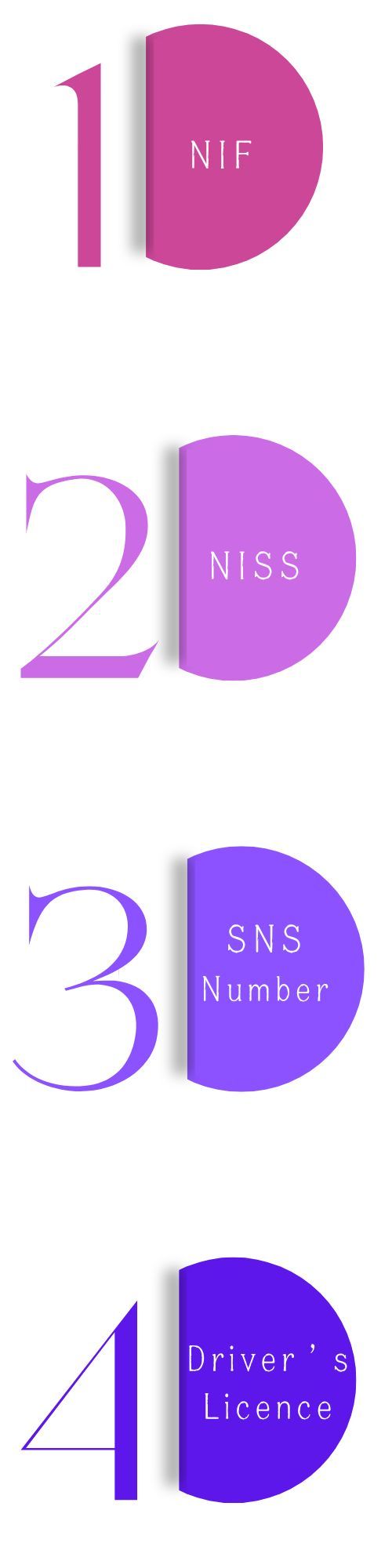

The 4 Basics to Relocate to Portugal

Cleuzina Cruz | Paralegal

When embarking on the journey of relocating to a new country, one must diligently attend to certain obligations. These obligations are imperative for both maintaining legal status within the country and accessing the various services provided by the host country.

At LVP Advogados, our specialised paralegal team is dedicated to providing top relocation services, guaranteeing a seamless transition for foreigners looking to settle in Portugal.

To establish a life with full entitlement to rights in Portugal, the following four pillars are essential.

1st Basic: The NIF Number

If you are considering moving to Portugal, obtaining a Tax ID Number (known as Número de Identificação Fiscal or NIF) should be your first priority. This number is crucial for personal identification purposes such as acquiring goods or services, making contracts, opening bank accounts, signing contracts, and buying properties or vehicles.

It is worth noting that non-European Union residents looking to purchase a property or vehicle in Portugal are required to appoint a Tax Representative.

Furthermore, it is important to emphasise that acquiring a NIF (Número de Identificação Fiscal) number qualifies individuals to achieve fiscal residency status in Portugal.

2nd Basic: The NISS Number

If you plan to work in Portugal for a Portuguese-based company or as a freelancer or self-employed in Portugal, you will need a Social Security number.

Additionally, whether you are employed by a Portuguese company or work in Portugal as a self-employed individual or freelancer for a company based outside Portugal, you are required to pay social security contributions.

Besides its function on employment-related affairs, it is imperative to highlight that the possession of the NISS (Número de Identificação da Segurança Social) number is indispensable for obtaining a European Health Insurance Card (EHIC). Without the NISS number, the acquisition of the EHIC is unattainable.

3rd Basic: The SNS Number a.k.a Health Number

This is an identification number that enables your recognition across Public Health institutions and services.

The SNS number is accessible to individuals possessing a Resident Permit or Registration Certificate from the European Union, enabling them to enrol in the National Health System.

Portugal's Serviço Nacional de Saúde (SNS) stands out for its commitment to universal access, providing extensive healthcare services to all residents. Embracing a multidisciplinary strategy, the SNS consistently allocates resources towards the development of new facilities and the adoption of advanced medical technologies, thereby elevating the standard of the care provided.

It should be emphasised that individuals are only assigned the number once they have established residency in Portugal.

4th Basic: Driver's licence

The Portuguese driver's licence will allow you to drive in all countries of the European Union.

Drivers from EU countries are allowed to drive in Portugal with their country’s licence until the expiration date, however, it is essential to register it if you are residing in Portugal.

Drivers from Countries outside of the EU, and with a bilateral agreement with Portugal, can drive in Portugal with a foreign driving licence for 185 days after entering the country and before taking up residence (driving as a tourist).

Drivers from countries without bilateral agreement with Portugal can request the exchange of their driver's licence for a Portuguese one but will have to take a theoretical and a practical exam.

The fundamental requirement for obtaining a Portuguese driving license is to establish tax residency in Portugal.

Once these four pillars are successfully established, daily life in Portugal becomes significantly smoother. Our paralegal team stands ready to assist you in achieving any of these essential steps to have an amazing experience in Portugal.

Should you have further inquiries regarding this matter, get in touch with

Cleuzina Cruz, who will be delighted to assist you.