Portugal’s Golden Visa Rules will change in 2022

Portugal's Golden Visa Scheme was introduced in 2012 and, over the years, it has proven to be one of the best and most respected residency by investment programmes in the world. However, new rules will enter into force on 1st January 2022 and there will be no transitional period (Decree-Law no. 14/2021, of 12th February).

The good news is that all Golden Visa applications submitted until the end of this year will benefit and be granted under the current rules.

Which investment thresholds will change?

The Real Estate Investment and the Real Estate Investment and its rehabilitation for

Residential Purposes

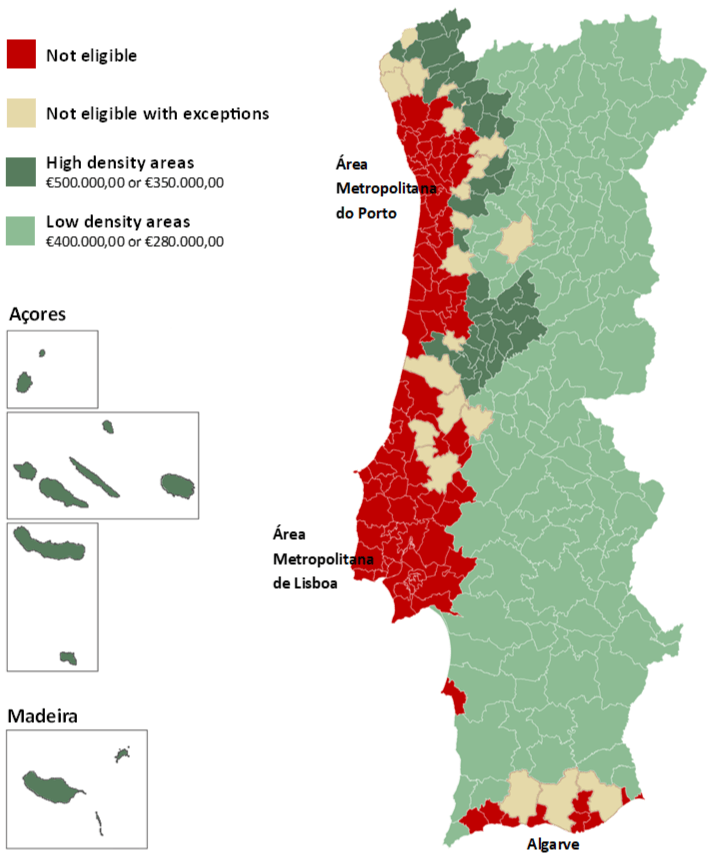

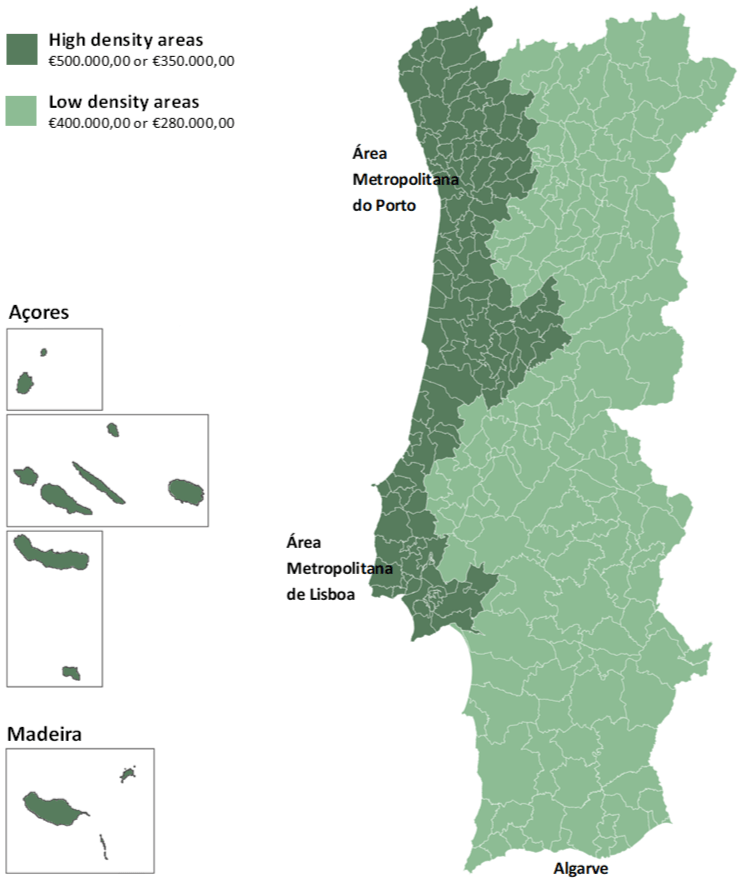

The real estate investment for residential purposes will be limited to properties located in the interior territories of Portugal and on the islands of Madeira and Azores. The minimum investment amounts will remain unchanged: €500,000.00 (reduced to €400,000.00 if located in a "low density area"), or €350,000.00 (reduced to €280,000.00 if located in a "low density area").

The Real Estate Investment and the Real Estate Investment and its rehabilitation for Non-Residential Purposes

The minimum investment amount will remain unchanged: €500,000.00 (reduced to €400,000.00 if located in a "low density area"), or €350,000.00 (reduced to €280,000.00 if located in a "low density area").

The Financial Investment

The transfer of at least €1 million will change its minimum to €1.5 million.

The Investment in Units of Portugal-regulated Funds

The acquisition of participation units in investment funds or venture capital funds dedicated to the capitalisation of companies, provided that the fund invests at least 60% in Portugal-registered businesses, and that the maturity of the said units is no less than 5 years from the date they are bought, changes from €350,000.00 to a minimum amount of €500,000.00.

The Investment in Scientific Research

The investment in scientific research which is applied to research activities developed by public or private scientific research institutions, integrated in the national scientific and technological system also changes from €350,000.00 to a minimum amount of €500,000.00 (reduced to €400,000.00 if located in a "low density area").

The Investment in setting up a Portuguese Company

The investment in setting up a company that creates and keeps 5 new permanent jobs, or in increasing the share capital of an existing Portuguese company that creates or keeps at least 5 permanent jobs for a minimum period of 3 years, changes from €350,000.00 to a minimum amount of €500,000.00.

The new rules apply to all applications for residence permits by investment requested after the date of entry into force of the new Decree-Law, as of 1st January 2022.

Please note that since the UK has now officially left the EU, UK citizens will also be able to apply for the Golden Visa in Portugal, enabling them to obtain residency in an EU country.