The online platform opened for the new Golden Visa applications.

The "Golden Visa" (officially "ARI") is a residency-by-investment programme and the types of eligible investments (which must be free of all charges at least up to the minimum required amount) are currently the following:

1. The transfer of at least €1.5 million to Portugal, which may have one of the following investment sub-types:

1.1. A bank deposit;

1.2 The purchase of a shareholding in a Portuguese company or the incorporation of a single-member private limited company having a paid-up share capital of at least €1.5 million, such company being free to invest wherever and in whatever it wants;

1.3. The purchase of Portugal sovereign debt instruments;

1.4. The purchase of any securities issued by Portugal-based entities.

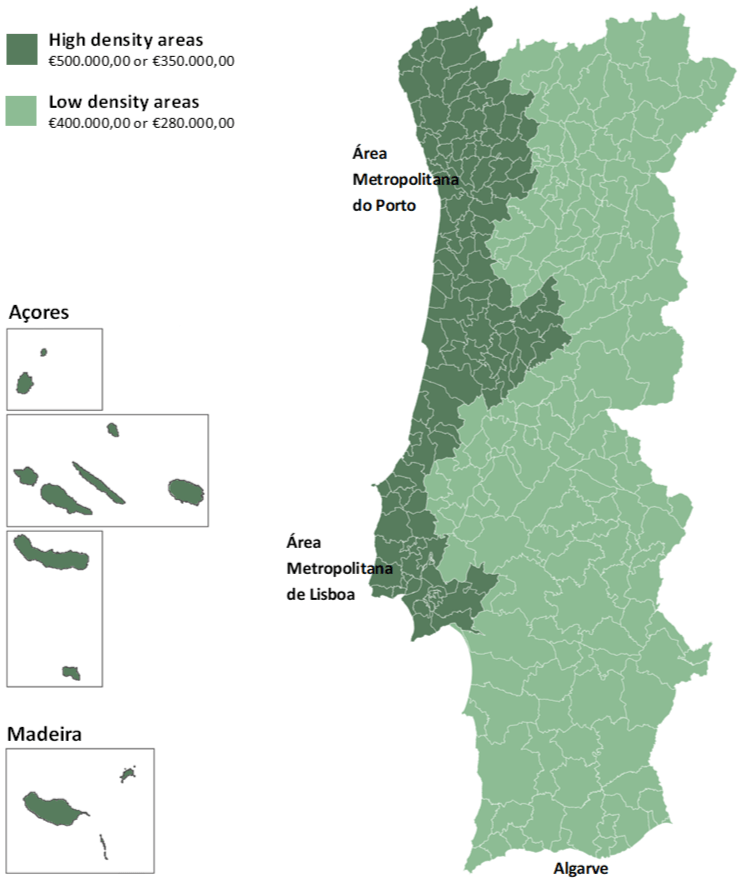

2. The Real Estate Investment and Real Estate Investment and its rehabilitation for Non-residential Purposes of at least €500,000.00 (reduced to €400,000.00 if located in a "low density area"), or €350,000.00 (reduced to €280,000.00 if located in a "low density area"), respectively.

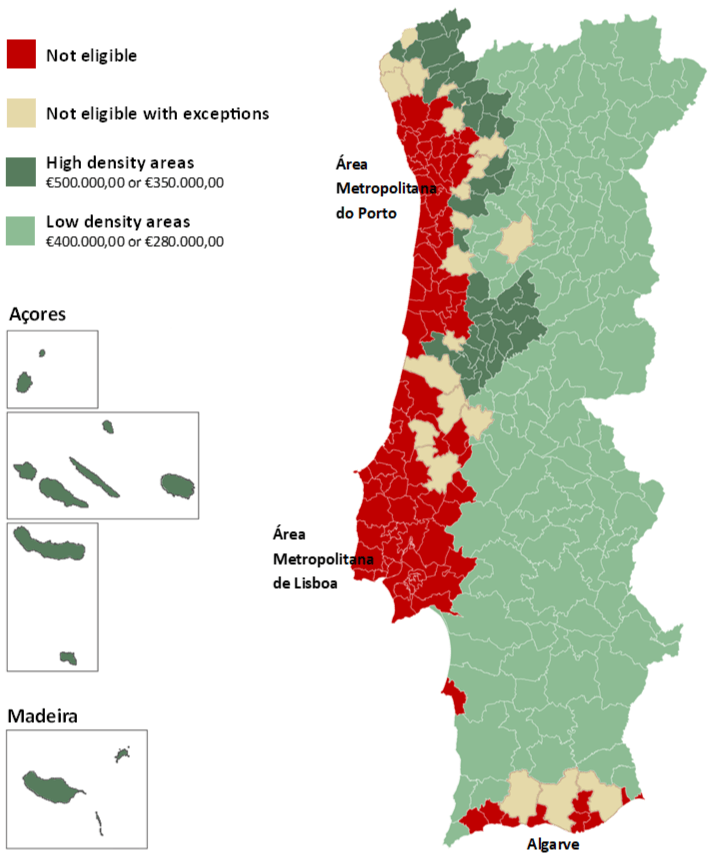

3. The Real Estate Investment and its rehabilitation for Residential Purposes will be limited to properties located in the interior territories of Portugal, identified in the Annex to Ministerial Order no. 208/20017 of 13th July, and in the islands of Madeira and Azores; moreover, it will keep the same investment minimum amount: €500,000.00 (reduced to €400,000.00 if located in a "low density area"), or €350,000.00 (reduced to €280,000.00 if located in a "low density area").

NOTE: Real Estate Investments for residential purposes will be excluded from the Golden Visa scheme in the Lisbon Metropolitan Area, the Oeste territory, the Porto Metropolitan Area (except for the Municipality of Arouca and the parishes of Junqueira and Arões in the Municipality of Vale de Cambra) and in almost all of the Algarve territory. The exceptions in the Algarve are the Municipalities of Alcoutim, Aljezur, Castro Marim, Monchique and Vila do Bispo, the parishes of Alte, Ameixial, Salir, Union of Parishes of Querença, Tôr and Benafim in the Municipality of Loulé, the Parish of São Marcos da Serra in the Municipality of Silves, and the Parishes of Cachopo and Santa Catarina da Fontes do Bispo in the Municipality of Tavira.

4. An investment of at least €500,000.00 in scientific research conducted by accredited institutions that are part of the national scientific and technological system (reduced to €400,000.00 if located in a "low density area"), but please note that such projects open to private investors do not currently seem to be available.

5. Investing at least €500,000.00 in units of Portugal-regulated funds dedicated to the capitalisation of companies, provided that the fund invests at least 60% in Portugal-registered businesses, and that the maturity of said units is no less than 5 years from the date they are bought.

6. Investing at least €500,000.00 in setting up a Portuguese company that creates and keeps 5 new permanent jobs, or in increasing the share capital of an existing Portuguese company that creates or keeps at least 5 permanent jobs for a minimum period or 3 years.

7. A business, in the format of a single-member private limited company (no minimum investment is required), that creates and keeps at least 10 new permanent jobs in Portugal (reduced to 8 if located in a "low density area").

"Low density areas" are regions having less than 100 inhabitants per square kilometre or a per capita GDP of less than 75% of the national average. In practice, this applies to the whole of Portugal with the exception of the coastal areas south of the River Lima and north of the River Sado, and of the islands of Madeira and Azores.

The investment must be kept for the whole duration of the Golden Visa and it may only be replaced in the meantime provided that:

- The new investment be of the same investment type (or subtype of #1 type); and

- The replaced investment be disposed of only once the new investment has been made.

The only way in which investments may be freely varied is to have them made through a single-member private limited company having a paid-up share capital of €1.5 million. If you would like to know more about this option, feel free to get in touch with us.

To apply for a Portugal “Golden Visa”, an applicant must do the following:

- Choose an investment route;

- Appoint a Portugal tax representative and a taxpayer ID number, known as NIF;

- Open a bank account in Portugal;

- Transfer the required amount from abroad thereto, which may be done in more than one transfer and from any non-Portuguese territory;

- Make the required investment from the Portugal banking account of the Investor;

- Once all the required paperwork (including that in connection with the investment) is ready, submit the application and the required documentation on the online platform SEF – Serviços de Estrangeiros e Fronteiras - The Immigration and Border Service;

- Pay the Government initial application fee;

- Once notified by SEF, schedule and attend the biometrics-collection appointment and submit the original documents (dependent applicants, including babies, must also attend a biometrics-collection session, although they can do it at a later stage);

- Once the application is approved, pay the Government final permit issue fees (which by law will take up to 90 days); and

- Collect the residence cards.

The procedure for each renewal of the Golden Visa - every two years - is similar and the programme's minimum stay requirements - 14 nights in each 2-year period - must be complied with. The renewal appointments at SEF must take place between 90 and 30 days before the residence card’s expiry date; therefore, you may want to plan your trips accordingly.

At the end of the 5th year, the Golden Visa holder has at least 3 alternative possibilities:

- Continue to renew the Golden Visa every 2 years, for which the investment must be kept in place; or

- Apply for “permanent residency for investment”, subject to passing a language test of “basic Portuguese”, for which no minimum stay requirements then apply (note that this is a recent legal provision and it is not yet clear whether or not the original Golden Visa investment must be kept in place); or

- Apply for Portuguese citizenship, also subject to passing a language test of “basic Portuguese”.

If you are keen on becoming an investor in Portugal and benefitting from this program, we can provide full bureaucratic and legal assistance with your Portuguese residence permit. For further information, please contact us at info@lvpadvogados.com.

Madalena Viana Pedreira

Lawyer