COVID Scenario is Looking Brighter in Portugal

Portugal has been in lockdown for two months but fortunately such measures were successful, and the country has been opening up for a month now.

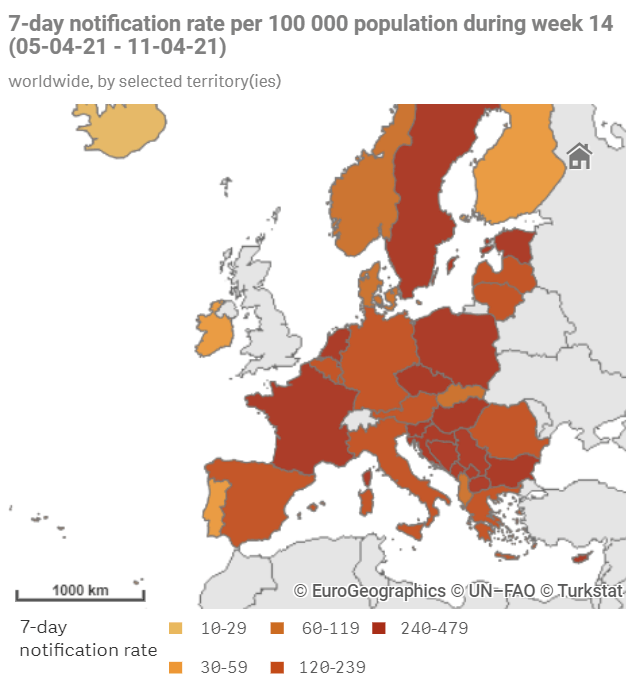

Although many European countries are still experiencing severe tightening actions, Portugal is cautiously widening the number of services allowed.

Source: ECDC

This being said, next Monday the country will move forward to the next phase.

Nevertheless, since there are still certain COVID focus points, 4 municipalities will have to go back to the previous phase, 7 will remain in the current one, and the rest of the country will move forward.

Attending high school and universities is the measure that will go ahead for all municipalities.

A New State of Emergency is entering into force today, 16th April and will last for two weeks. Hopefully, it will be the last.